Significance of Seeking Corporate Tax Return Services

Corporate Tax Return Services – The modern business landscape demands that one navigate the complex and ever-changing terrain effectively. This can prove to be daunting for any organization. However, seeking professional services has become quite important for businesses that aim to ensure compliance, optimize tax liabilities, and focus on their core operations. These services allow one to seek specialized expertise with up-to-date knowledge of tax-related laws as well as related strategic planning. This can greatly benefit companies of all sizes.

Importance of Corporate Tax Return Services

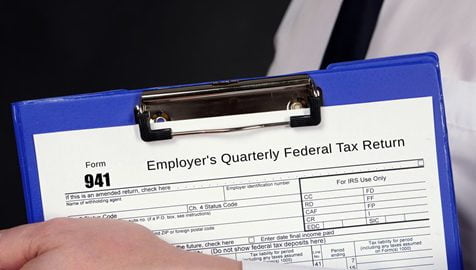

Help ensure compliance

Compliance with tax regulations is a concern for all businesses. Tax laws are intricate and change quite frequently. Corporate Tax Return Services helps one to keep up with the latest changes and makes sure that all filings are accurate and submitted on time. This helps minimize the risk, penalties, audits, and legal issues that might be related to it. Multinational corporations opt for professional services to help them abide by tax law effectively.

Optimizing tax liabilities

Seeking professional Corporate Tax Return Services helps one optimize tax liabilities. Professionals easily identify incentives, credits, and other opportunities that a business might overlook. By making use of these opportunities, companies can reduce their taxes. They can improve their overall financial performance. Experts can also advise companies on strategic decisions.

Saving time and resources

Preparing and filing tax returns happens to take a lot of time and requires a detail-oriented approach. Outsourcing this task allows a business to focus on its core operations and objectives. Experts, on the other hand, handle tax-related matters efficiently. This improves the overall performance and ensures that the tax return process is carried out effectively. The professionals effectively navigate the complexities associated with tax. The resources that are received in the process can effectively be redirected to drive growth as well as increase profit.

Access to technology as well as expertise

Corporate Tax Return Services make use of the skills of professionals with years of experience. Their knowledge and expertise in the field of tax law and accounting can be of significant help. They also make use of advanced software and technology to manage taxes and data accurately and efficiently. With expertise and technology, professionals make sure that businesses receive high-quality service and reliable results. Besides these, services can provide valuable insights and advice when it comes to tax planning and financial management.

Risk management

When it comes to seeking professional Corporate Tax Return Services, experts happen to be quite versed when it comes to identifying potential risks and putting in place various strategies that can help mitigate them. They conduct reviews and make sure that all tax-related activities meet the current laws and regulations. This approach helps businesses avoid mistakes that might prove to be costly and reduce the likelihood of audits. During audits, having a professional can provide extensive defense and support throughout the process.

Strategic planning

Effective tax planning can be quite important when it comes to long-term business. The tax return services offer strategic planning that helps companies align their financial goal effectively by incorporating tax planning into an overall strategy. Businesses can improve their financial stability when it comes to competitive advantage.

Conclusion

Corporate Tax Return Services have become quite important in recent times for businesses of all sizes. Consider S&T Associates CPAs LLC, for they offer both skill and expertise when it comes to helping businesses effectively comply with rules and understand corporate tax rates better. They help businesses grow and provide them with updated knowledge related to tax filing services. They can play an extensive role when it comes to streamlining the approach and maximizing financial efficiency. Get in touch with them today.